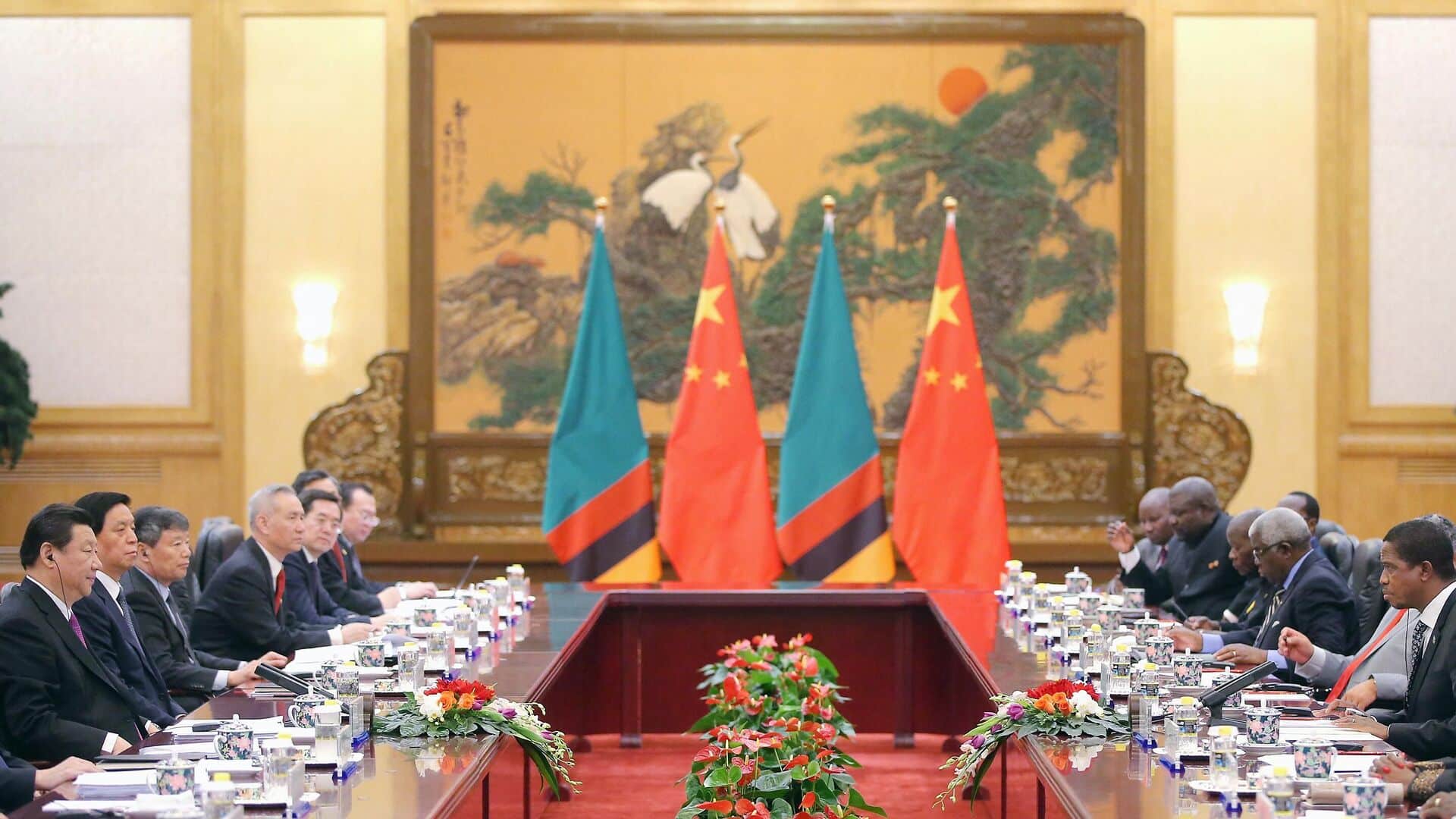

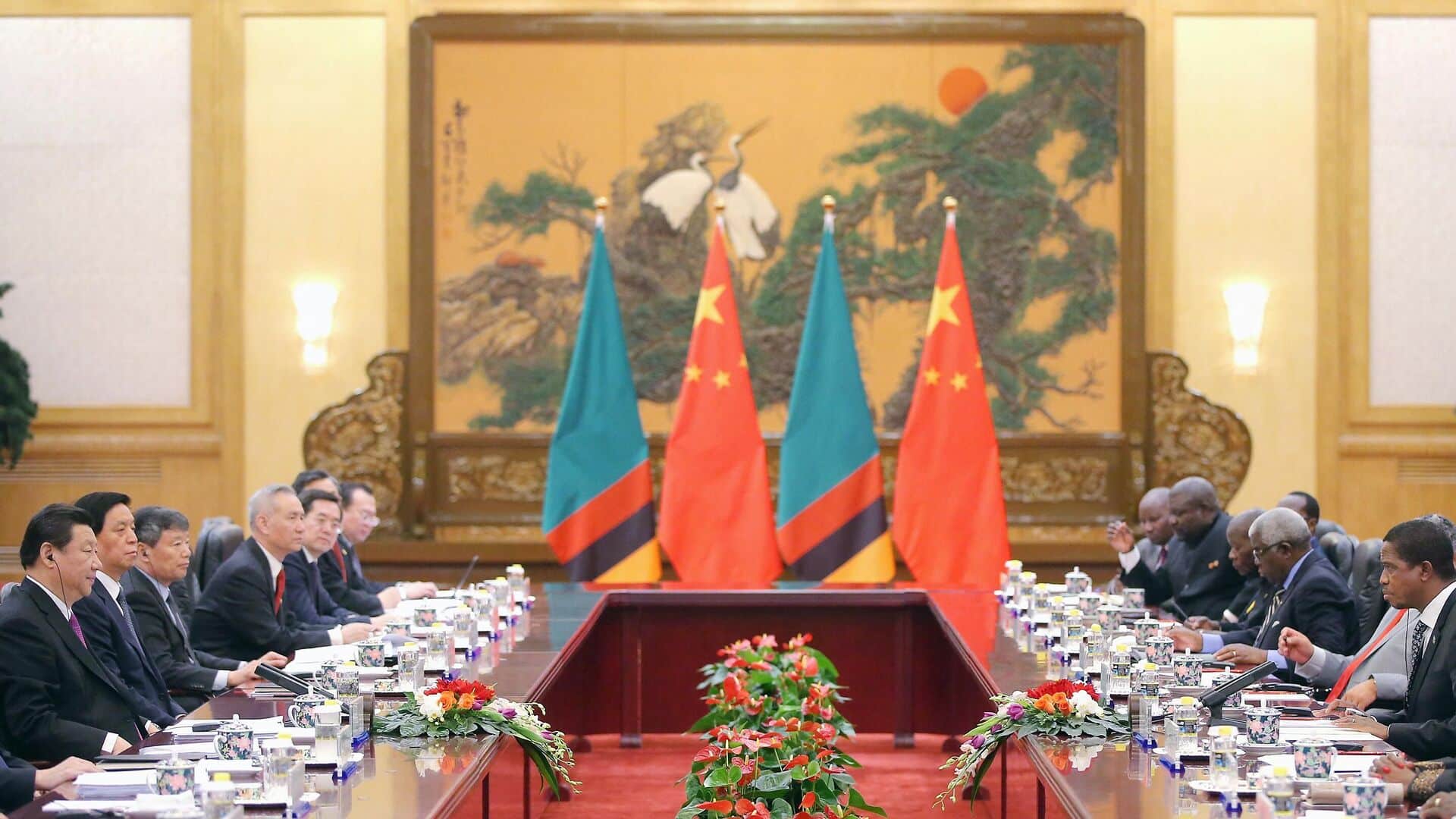

Chinese President Xi Jinping (Left) meets with Zambian President Edgar Chagwa Lungu (Right) at the Great Hall of the People in Beijing on March 30, 2015. Photo: Feng Li/AFP.

Orinoco Tribune – News and opinion pieces about Venezuela and beyond

From Venezuela and made by Venezuelan Chavistas

Chinese President Xi Jinping (Left) meets with Zambian President Edgar Chagwa Lungu (Right) at the Great Hall of the People in Beijing on March 30, 2015. Photo: Feng Li/AFP.

“We do hope [US Treasury Secretary Janet] Yellen can manage to prevent the US from defaulting on its obligations and protect the country’s credit,” the embassy added, referring to the financial crisis unfolding in Washington that threatens to cause a default on the US’ national debt.

“I know the Chinese have been a barrier to concluding the negotiations,” Yellen said, adding that while at the World Economic Forum in Davos, Switzerland, last week, she specifically raised the issue of Zambia [with Chinese officials] and asked for their cooperation in trying to reach a speedy resolution. “And our talks were constructive.”

China’s Donation to Cuba Will Meet ‘Most Pressing Needs’ Created by US Blockade, Economist Says

However, western lenders were frustrated when then-President Edgar Lungu looked to Beijing for help and made moves to nationalize the country’s valuable copper mining industry instead of the kind of privatization and budget-cutting typically mandated by the International Monetary Fund. When Hichilema, Zambia’s richest man and a western-educated financier, won elections in 2021, investors in Europe and North America celebrated.

Now, the country has become a key part of the narrative of “debt-trap diplomacy” pushed in the West, which claims that Chinese banks engage in predatory lending in Africa and Asia in order to strong-arm governments into adopting pro-Beijing politics.

In reality, China routinely forgives debt accumulated by nations that borrow from it, and its loans carry less conditions mandating internal policy changes than those of western lenders, like the IMF. That has made China the preferred lender across much of the Global South.

In the case of Zambia, China owns just 22% of the country’s debt, with 46% owed to western private lenders like Black Rock, 8% to governments other than China, and 18% to multilateral institutions like the IMF. According to the UK-based NGO Debt Justice, some of those private lenders are set to make profits of between 75-250% from Zambia’s debt if it were paid in full.