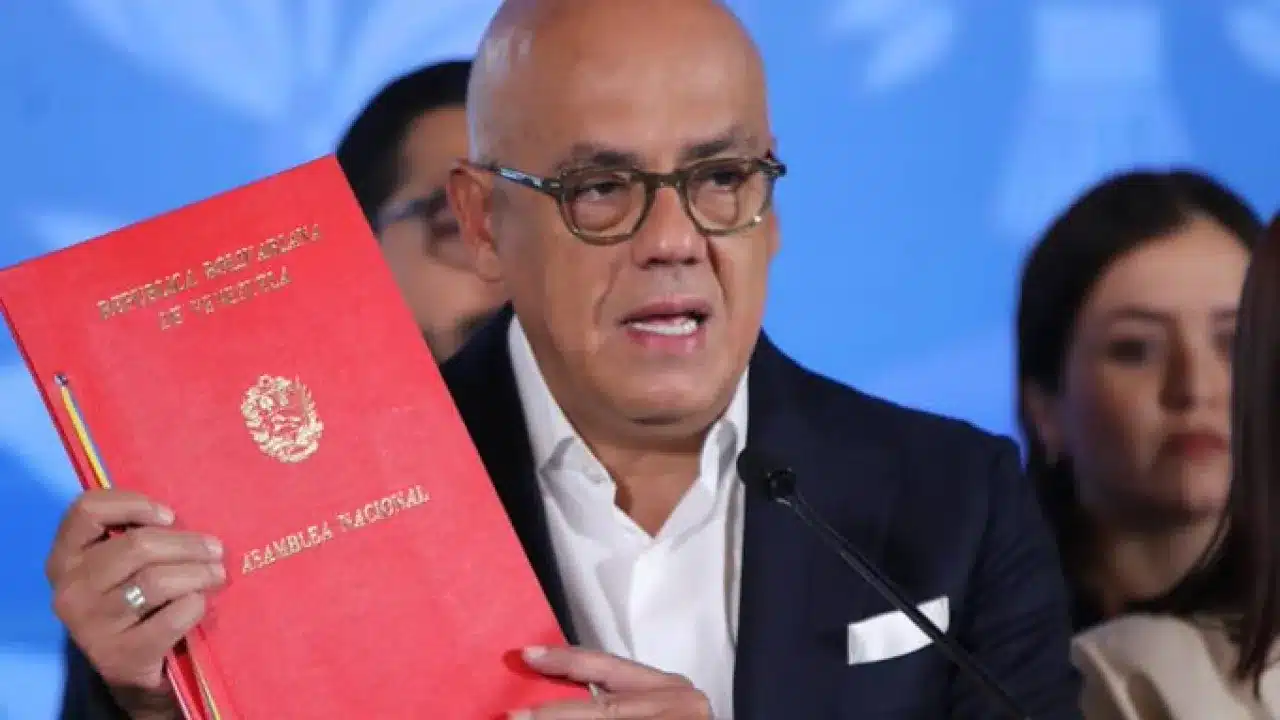

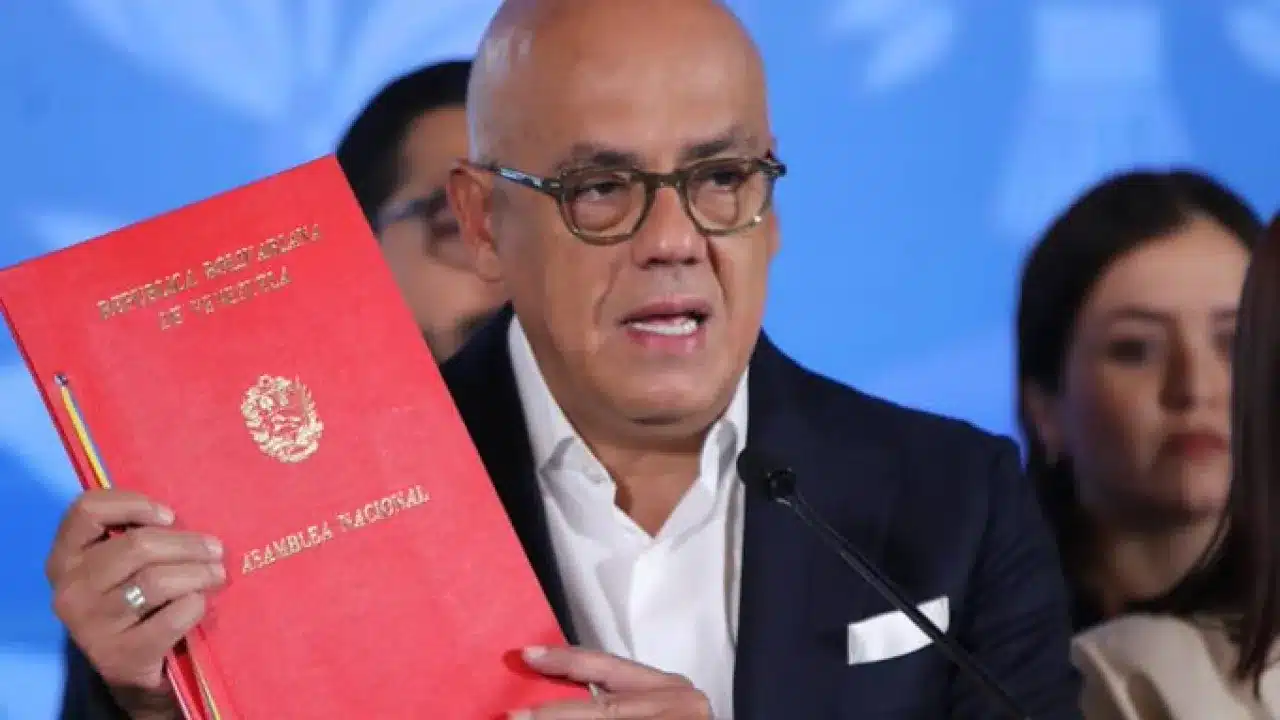

Venezuelan National Assembly President Jorge Rodríguez holds the file of the newly approved Organic Law for the Coordination and Harmonization of the Tax Powers of the States and Municipalities. Photo: Reporte Confidencial.

Orinoco Tribune – News and opinion pieces about Venezuela and beyond

From Venezuela and made by Venezuelan Chavistas

Venezuelan National Assembly President Jorge Rodríguez holds the file of the newly approved Organic Law for the Coordination and Harmonization of the Tax Powers of the States and Municipalities. Photo: Reporte Confidencial.

The National Assembly of Venezuela has approved the Organic Law for the Coordination and Harmonization of the Tax Powers of the States and Municipalities.

The law was approved by the National Assembly during a second round of discussions on Tuesday, July 18. It is aimed at protecting the rights of Venezuelan people embroiled in tax issues.

Jorge Rodríguez, the president of the National Assembly, emphasized that the primary objective of this law is to establish a systematic framework for tax regulations while safeguarding the rights of individuals, merchants, entrepreneurs, and small businesses. Additionally, the law aims to bring benefits to the municipalities in the country’s small towns, as it enables the consolidation of tax payments for these entities and their respective states. This measure seeks to streamline tax processes and promote more efficient fiscal management at the local level.

#18Jul || Queda aprobado por Mayoría Calificada el Proyecto de Ley Orgánica de Coordinación y Armonización de las Potestades Tributarias de los Estados y Municipios pic.twitter.com/Ooi9tqwNwX

— Asamblea Nacional 🇻🇪 (@Asamblea_Ven) July 18, 2023

Rodríguez urged the National Assembly deputies to embark on a nationwide campaign to disseminate comprehensive information about the new law, ensuring it does not succumb to the “gray zone of lies, fake news, and manipulation.”

“Let us not allow a law of such great importance to fall into the gray zone of fake news, lies, and manipulation,” he said. “On the contrary, let us give to the citizens this powerful instrument that will protect them.”

National Assembly Deputy Jesús Faría: Venezuela Moving Towards New Tax System

Deputy Nicolás Maduro Guerra emphasized that this law plays a pivotal role in creating the essential micro- and macro-economic equilibrium required to stimulate the country’s economy.

He further elaborated that the newly enacted legislation comes with a well-structured immediate implementation plan, closely coordinated with the government. This strategic approach aims to instill heightened confidence among international investors, local entrepreneurs, community enterprises, and cooperatives, thereby fostering an environment conducive to economic growth and development.

#EnVideo📹| Diputado de la AN @nicmaduroguerra detalló que la Ley Orgánica de Coordinación y Armonización de las Potestades Tributarias, aprobada por la AN por mayoría calificada, generará orden en impuestos municipales, nacionales y regionales.#CuadrantesPorLaVidaYLaPaz pic.twitter.com/WmR8cIX7fM

— VTV CANAL 8 (@VTVcanal8) July 19, 2023

“Starting from today, there will be more order in the municipal, regional, and national taxes,” he said.

He stressed that this law is a victory for the people, the economy, and the workers at the municipal, state, and national levels.

The Organic Law of Coordination and Harmonization of the Tax Powers of the States and Municipalities consists of seven chapters with a total of 53 articles. It will now be submitted to the Constitutional Chamber of the Supreme Court of Justice for evaluation regarding the constitutionality of the legislation, and will thereafter pass to the president in order to finally become law.

(RedRadioVE) by Ana Perdigón

Translation: Orinoco Tribune

OT/SC/KZ

Support Orinoco Tribune team’s unique, amazing, and unmatched work!

5.5 years providing honest and responsible anti-imperialist information about the Global South!

66 months working for you, 18.5K posts published, 60 original pieces in the last 4 months, 21 YouTube interviews over the last 12 months, and much more to come!

Your donations make a big difference!