Central Bank of Venezuela (BCV) headquarters in Caracas with BCV flag and the Venezuelan flag. File photo.

Orinoco Tribune – News and opinion pieces about Venezuela and beyond

From Venezuela and made by Venezuelan Chavistas

Central Bank of Venezuela (BCV) headquarters in Caracas with BCV flag and the Venezuelan flag. File photo.

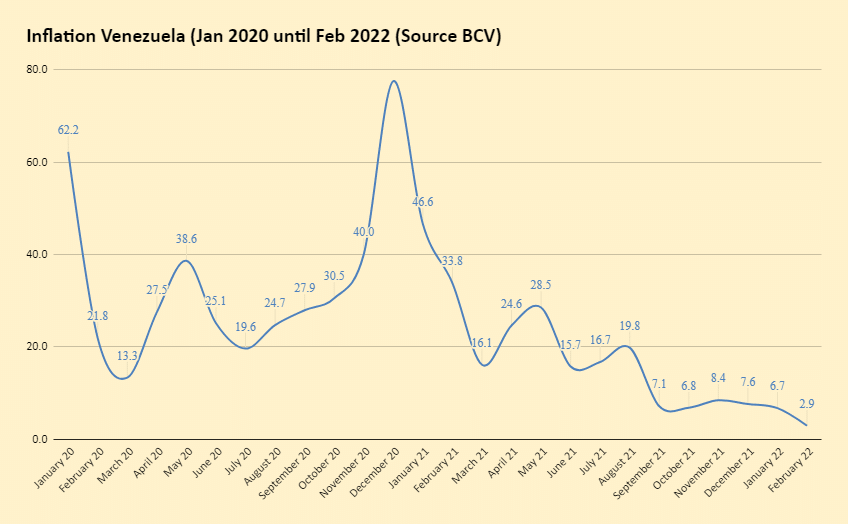

Caracas, March 5, 2022 (OrinocoTribune.com)—The inflation reported in Venezuela during February was 2.9%, the lowest since the same month in 2014, according to the most recent data from the Central Bank of Venezuela (BCV). Meanwhile neighboring Colombia registered an inflation of 1.63%, the highest since March 2001, 21 years ago.

Venezuela has suffered chronic inflation for several decades. From 2017 until December 2021 the inflation worsened, and Venezuela entered into a hyperinflation cycle ignited by Washington and Europe’s blockade, with monthly inflation rates ranging from 30 to 190%. Last December, after 12 months with monthly inflation rates below 50%, the country was officially out of hyperinflation according to most econometric standards.

RELATED CONTENT: Inflation in Venezuela Continues to Cool Down (+Tax on Transactions in US Dollars)

The accumulated variation of the Consumer Price Index (CPI) in Venezuela for February 2022 was 9.88%, and the annualized inflation in February went down to 340.44% from 472.5% in January.

Communication and Education Services sectors were the ones that varied the most in February, with 23.1% and 17.5% respectively. These sectors are followed in percentage of variation by Leisure and Culture (8.4%), Transportation (6.2%) and Miscellaneous Goods and Services (4.6%).

RELATED CONTENT: Venezuela Officially Exits Hyperinflation – Central Bank of Venezuela

On the other hand, the sectors that had lower inflation in February were Restaurants and Hotels (2.7%), Housing Rentals (2.5%), Alcoholic Beverages and Tobacco (2.2%), Food and Non-Alcoholic Beverages (1.1%), Health (0.8%), and Clothing and Footwear (0.4%).

This is the first time since June 2015 that Venezuela has monthly inflation in single digits for more than six consecutive months. The variation of inflation in January was 6.7%, according to the Venezuelan Central Bank.

Many pro-market economists have alerted in recent days—after President Maduro announced a significant increase in the minimum wage—about the risk of inflationary pressure coming back soon. Government officials and President Maduro explained during the minimum wage raise announcement that the adjustment is being done with real financial resources, meaning that inorganic money won’t be printed.

Additionally, government spokespersons have highlighted the tight control that the BCV has over the exchange rate in recent months, with the national monetary authority intervening in the exchange rate market when the parameters move beyond the monetary plan. They have also highlighted the amendment to the law on large financial transactions, that will tax transactions in foreign currencies and cryptocurrencies other than the official cryptocurrency Petro, as another tool to push the holders of foreign currency to use Bolívars, thus oversupplying the market with foreign currency to lower the price of US dollar.

Featured image: Central Bank of Venezuela (BCV) headquarters in Caracas with BCV flag and the Venezuelan flag. File photo.

Special for Orinoco Tribune by Jesús Rodríguez Espinoza

OT/JRE/SC

You must be logged in to post a comment.