The Petro: Has it been a “Resounding Failure” and a “Laughing Stock”? What Can We Expect?

Orinoco Tribune – News and opinion pieces about Venezuela and beyond

From Venezuela and made by Venezuelan Chavistas

A few days ago, an article by Venezuelan economist Luis Enrique Gavazut caused great controversy in social networks. Entitled ” One year after the Recovery, Growth and Prosperity Program: What is the life of El Petro? “, it was published on the portal “15 y Ultimo” edited by Luis Salas. The author tried to do an accounting of the famous Venezuelan cryptocurrency 12 months after President Nicolás Maduro had launched economic measures of great importance for the country.

Although Gavazut, in his article, makes strong criticisms of those who defended the elimination of exchange control and how little this has helped to solve hyperinflation and the crisis, perhaps the most controversial part in the piece was his opinion on the Petro, which summarizes in: “Another resounding failure.” He even states that “the petro, after being rated by the Dagong agency, the most influential risk rating agency in China, as a ‘financial genius’, is currently nothing more than a joke in the world of cryptocurrencies. What an outrageous disappointment!”

He explains:

Its explicit objectives were to strengthen the bolivar, that is, to stop the devaluation and even reverse it, supporting the value of our currency in oil wealth and attracting currencies to the national exchange market; as well as providing a means to circumvent the sanctions in the international financial system, particularly in the Swift interbank transfer system, that is, a means to be able to make international payments without going through the Swift and thereby overcome the difficulties for the normal development of our foreign trade.

Needless to say, none of those goals were achieved. When a project does not achieve its objectives, it is declared unsuccessful. Period.

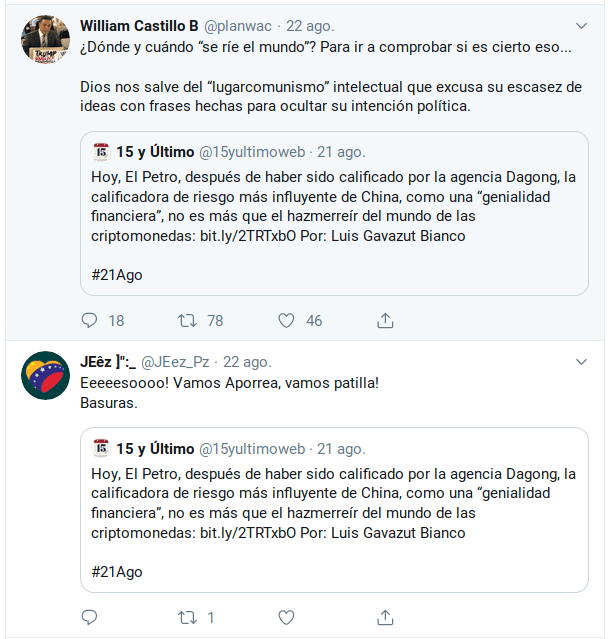

His comments, which were provocatively replicated by the Twitter account of 15 y Ultimo, caused angry responses from some Chavistas, as well as ant-Chavista trolls.

Now: Was the Petro really to be consider a resounding failure? Is it currently a joke? Can its death be decreed?

Communication errors and inability to debate

Actually, you can’t be upset with Gavazut’s opinion. We all remember that, when the Petro was announced, there was a communication maelstrom of support for it from the government, even from people, officials and spokesmen who really did not understand or were not sure what it implied.

That is understandable. Venezuela is a country under harassment of the US government and its allies for at least 20 years, in an attempt to take control of our resources. Every time the government proposes a new plan, a new idea, a new project to solve the problems that our country has, there is a storm of responses from politicians, opposition media and supposed specialists discrediting the idea, however good it may be . From La Patilla to CNN, passing through The New York Times, El País de España or Clarín from Argentina, including many artists from the world of entertainment and show business, everyone goes out in unison to rant about any idea that comes from Chavismo.

And, unfortunately, we in Chavismo have become accustomed to answering the opposite: we applaud every idea that comes from this side unanimously, many times without thinking about it, without meditating on it, without discussing it. It is certainly discussed internally somewhere – I suppose in the National Directorate of the PSUV, or around there – but once it is approved and publicly announced, everyone supports it and whoever does not is suspected of treason: is criticized, insulted or isolated. A person knowing that something is going to go wrong, has no space to say it.

Personally, I think that, in that first stage of the Petro, people who were not trained, who did not have all the necessary economic and technical knowledge , or political commitment were appointed to this very important project, and that finally had to be removed. In spite of that, we all support the project in very good faith and keep the reservations we had for ourselves, knowing that if we bombarded the nascent project with our criticisms and doubts, we would help make it shipwrecked.

There were many well-intentioned colleagues from many agencies, who began to promise things about Petro that were never fulfilled. And, not fulfilling, cause deep disappointment.

There was talk, for example, that the savings banks of the ministries would store their funds in Petros, as a way to preserve their value in the face of hyperinflation. There were even talks about delivering (crypto) miners to savings banks, and preserving the benefits of public employees in Petros. None of that was fulfilled, and those who stayed in the savings banks waiting for that promise to be fulfilled, lost their money before the devaluation progressed.

The government bought containers of crypto miners, which were assigned to universities, Infocentros and agencies , which was announced with fanfare.

As far as I know, most of these miners are not being used, possibly because of the problems in the Venezuelan electrical system. Its use, in any case, should be as transparent as possible.

RELATED CONTENT: This is What Happened in Venezuela with Bitcoin Transactions after US Blockade

Other colleagues confused Petros with cryptocurrency, and people were encouraged to buy miners, although there were also state officials who confiscated them, prevented their importation or charged bribes for allowing their entry into the country, which brought much dislike and made visible strong contradictions within the State.

Need for trust

When the Petro was announced, I read all the opinions that arose in this regard: both that of extreme defenders and detractors. As much of the Chavismo, as of the opposition, as well as of people who know nothing of the Venezuelan political ring.

Of all the opinions I read about Petro, the one I considered most logical came from a member of the PSUV, economist, Marxist, former minister and today constituent. His opinion was made in a closed WhatsApp group, and unfortunately he never made it public. Therefore, I reserve his name. However, the compa, more than a year ago, was quite pessimistic about the fate of Petro and used almost the same words of Gavazut to anticipate its failure.

He explained that the problem with any cryptocurrency is that it has to build trust to be supported by investors. And, on that subject, there is a very popular saying: “money is a coward.”

The compa explained that it was very difficult for any investor in the world to invest their money in buying Petros because in the media there is a global campaign of attack against Venezuela that basically scares any investor from putting their money here, particularly when there are hundreds of other cryptocurrencies and dozens of other investment mechanisms that may be more profitable.

In fact, Donald Trump issued sanctions in 2018 against the Petro, threatening any American person or entity that deals in this cryptocurrency. This frightened not only potential oil buyers who also wish to have relations with the United States, but also cryptocurrency exchange pages, such as Binance or Coinbase, which, had they accepted the Petro, would have greatly facilitated the diffusion of Venezuelan cryptocurrency.

Therefore, there are questions that foreign investors – those who are not guided by sentimentalities, political ideologies or dreams of a better world – can ask about the Petro, and that no one has been able to answer.

If Maduro is overthrown, what will happen to thePetro? Venezuela is a country whose government is directly against the most powerful Empire in the history of humanity. For 20 years there have been dozens of attempted coups and plans to overthrow Hugo Chávez, and these plans have increased with the rise of Nicolás Maduro to the presidency of Venezuela and with the unfortunate arrival of Donald Trump to that of the US. There are threats of overthrow, murder, military intervention, naval blockade and direct invasion. And we cannot forget the retreat of the left in recent years in countries such as Brazil, Ecuador, Argentina, Honduras, El Salvador, among others, which has also involved the dismantling of many projects that progressive leaders such as Dilma Rousseff, Rafael Correa or Cristina Kirchner carried out.

The Petro is much more centralized than bitcoin and other cryptocurrencies. Its main attraction – the promise, from the Venezuelan government, that it is backed by oil in the Orinoco Oil Belt fields – is also its main weakness. And it’s that all the Petro’s technological infrastructure, servers and equipment are in Venezuela. If they overthrow Maduro, all that will be dismantled and the promise of oil support will disappear. Could someone have a Wallet on his computer with Petros, but if the government that promised to back those Petros with Venezuelan oil wealth disappears, only with difficulty, will anyone accept to exchange those Petros using the rate of 1 Petro = $ 60.

Therefore, betting on Petro is also betting on the permanence of Nicolás Maduro and the Bolivarian revolution in the presidency of Venezuela, and although that may be the personal decision and the risk that a Chavista Venezuelan like me takes, it’s very unlikelyly a foreign investor would decide the same, particularly if he has many other options.

What does it mean to be backed by Venezuela’s oil wealth? It is historical that fields of the Orinoco Oil Belt have been assigned to support the Petro, but what an investor may ask is: if I have a Petro and I want to be given its oil value, will it be delivered to me? The issue of Petro’s support with oil is difficult to understand in its execution because we are one of the first countries in the world to do so. And again it is tied to the permanence of Nicolás Maduro in the Presidency.

What does a foreign investor earn by having his money in Petros? Someone could buy bitcoins on the promise that, if he or she knows how to manage well because of their volatility, they can make easy money (they call it ” cryptotrading “). Who bought a bitcoin in March 2019, when it was at 3 thousand dollars, and sold it in June 2019, when it reached 12 thousand dollars, had a 300 percent profit in a very short time. But the foreign investor who bought a Petro in March with a value of 60 dollars, today still has 60 dollars.

It is true that the price of a barrel of oil could rise in the future as it starts to run out, but we are talking about a very long-term investment, maybe in 10 or 20 years. Again the question arises that a foreign investor can ask himself: will the Bolivarian revolution in power continue in 10 or 20 years? Will the Petro still exist?

It is also true that there are rumors about the dollar suffering a catastrophic fall and, in that case, keeping your money in a stable cryptocurrency, such as Petro, would be an excellent option.

The Petro would have been better accepted if what Hugo Chávez proposed in 2009 had been achieved: that was the currency of a multinational organization such as Opep, or of several oil-producing countries. Or if it would have been the currency of a group of countries, of a multilateral organization (the Alba? Unasur? Celac? Brics?) Or of a multi-state bank of importance, which would guarantee its permanence in time even if something wrong happened to the Venezuelan government.

I am almost certain they tried that, but the geopolitical circumstances and the fact that many governments are reluctant to accept cryptocurrencies for being such an incipient means of payment, surely made them shy away from the idea.

That is why patience is requested. In the midst of a trade war between the United States and China, and with US people slowly beginning to realize the terrible mistake they made by choosing Donald Trump, it is possible that global geopolitical circumstances may change in a few months or years and that the Petro, in the near future, may begin to be accepted or change its conception in such a way that it becomes more reliable for investors.

RELATED CONTENT: Tales of Resistance: No Growth or Prosperity

Anyway, I don’t believe that the Petro has failed. What I think is that its reach was overestimated and that many people talked about it without knowing, and promising impossible things.

Is Petro the “joke of the cryptocurrency world”? If we had never entered that world and, suddenly, we arrived at it in a presumptuous way, performing pompous acts, saying that Petro will save our economy, solve our problems of hyperinflation and economic blockade, will end the dollar and become the salvation of the world, it is inevitable that we become a joke worldwide. Not because the Petro works or not, but because we are huge heels. Even the creators of bitcoin have not been so presumptuous. The Petro is not to blame for us being so absurd in advertising and communicating. And it is worse if we gave the control of the Petro, at least at the beginning, to people who did not know about the subject, to Venezuelan political (opportunists) “puercoarañismo.”

But if we are humble, we use it to solve our problems, we make it grow and we prepare people, who knows we might end up giving the world a pleasant surprise.

The Petro today is not the cryptocurrency that would be eagerly bought by foreign investors thus saving our economy, but it can be very useful, especially for us Venezuelans. People are learning to use the Petro, some Venezuelan stores and businesses are starting to accept payments in Petros and many people are getting familiar with the PetroApp (I still am not validated as a user, despite the numerous times I have filled out the forms and sent my documents and selfies … I will keep trying).

Many of us use the Petros savings option of the Homeland System (Carnet de la Patria) to try to preserve the value of our money in the midst of this uncontrolled hyperinflation that we live without resorting to the purchase of US dollars.

The Petro is also emerging, along with the Homeland System, as a possible option to continue making transactions and payments in the event that Donald Trump’s “sanctions” result in Visa and MasterCard withdrawing from the country and debit cards stop working and credit, although we must remember that not everyone has access to smartphones, computers and the Internet.

Although it is not part of the Petro, the Patria Remesas system offered by the Venezuelan government is allowing money to be received from abroad using bitcoins, and although someone could say that the price of the official dollar that uses this system is less than parallel (black market), the fact is that Patria Remittances charge less commissions than pages like AirTM and the like, becoming a very attractive option to receive remittances and money from abroad. The only criticism is the delay for the money sent from the Homeland System to reach the bank account, which can take 3-5 days. Some friends report to me that they are earning some money on pages that pay with satoshis for viewing advertising, and then exchanging them into bolivars through Patria Remesas.

Gavazut is right that some decisions about the Petro, such as the successive changes of the White Papers and the negative opinions of some personalities in the international world of cryptocurrencies negatively influenced credibility about Petro. But those things were to be expected. I insist that what most affected its confidence are the constant attacks against Venezuela made by the media, and the constant threats of overthrow and invasion by Imperialism.

What will happen to the Petro in the future? We have to wait. The same cryptocurrencies are very recent: bitcoin was launched just 10 years ago, in January 2009, and nobody trusted it at that time. Today, we all regret not buying it when it was born.

Questions

And the unknowns are not only with the future of Petro, but with the world economy and geopolitics. What will happen to cryptocurrencies within 5, 10 or 25 years? What will happen to the trade war between the United States, Russia and China? Will the dollar fall? Will other fiat currencies be strengthened? Will the “Libra” cryptocurrency proposed by Facebook make a difference? What will happen to the threatened and attacked Venezuela? How much longer will the government of the discredited Donald Trump continue?

We would all like to know the answers. For now, we can only wait, resist and see what happens.

How can the Petro be improved? In my opinion, it is important that it be transparent. It’s very good that the block explorer has been published and that an API for developers has been activated, so that trade pages can know its price. It is also important that Petro-related applications publish their source code in public repositories, so that technical experts from the world of cryptocurrencies can check and validate the applications. Any investor first consults technical experts to know how reliable a cryptocurrency is, and if they do not, publish the source code of their related applications, the technicians will not trust it because they cannot examine said code. In addition, if the code is not free, applications may not be included in free software distributions such as Canaima GNU / Linux, or in Canaimitas.

Another thing: Hopefully we can arrive, within the Bolivarian process, at the moment when we can publicly discuss support or not for ideas such as Petro, without bein subject to insults, or without accusing us of “lugarcomunista intellectuals”, short of ideas, patilleros or traitors.

Source URL: El Espacio de Lubrio

Translated by JRE/EF

You must be logged in to post a comment.