Numerous hands raise the Venezuelan flag, with the Bitcoin symbol in the background, representing the widespread use of cryptocurrencies in Venezuela. Photo: CriptoNoticias.

Orinoco Tribune – News and opinion pieces about Venezuela and beyond

From Venezuela and made by Venezuelan Chavistas

Numerous hands raise the Venezuelan flag, with the Bitcoin symbol in the background, representing the widespread use of cryptocurrencies in Venezuela. Photo: CriptoNoticias.

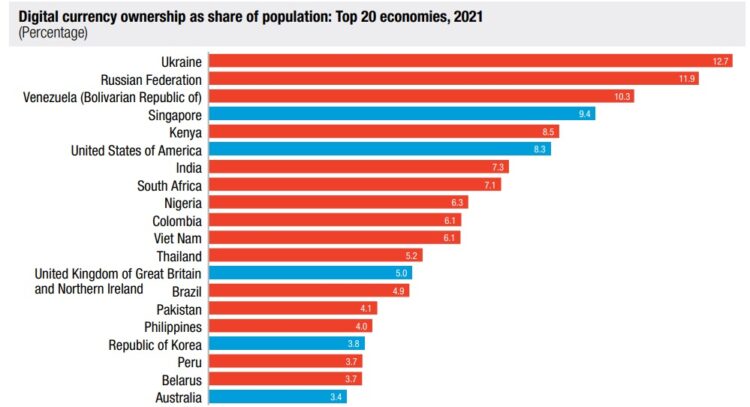

The United Nations’ Conference on Trade and Development found that in percentage terms, of any country in the world Venezuela has the third-highest adoption rate for bitcoin and other cryptocurrencies. Based on data from 2021, one in every ten Venezuelans, or 10.3% of the Venezuelan population, owns cryptocurrencies in one form or another.

The population of Venezuela is about 29 million. Therefore, according to UN data, almost three million Venezuelans have acquired a digital asset since this became possible.

The list of countries with the highest percentage of population holding cryptocurrencies is headed by Ukraine (12.7%), followed by Russia (11.9%). Just below Venezuela are Singapore (9.4%), Kenya (8.5%), and the United States (8.3%).

Moreover, Venezuela is not the only South American country that is a fan of cryptocurrencies. Among the top 20 are two more countries of the continent: Colombia (10th place, with 6.1%) and Peru (18th place, with 3.7%).

RELATED CONTENT: Crypto Platform Uphold Leaves Venezuela due to US Blockade

According to criptonoticias.com, the UN body highlighted that 15 of the 20 countries with the highest cryptocurrency adoption rate are emerging and developing economies. The main reasons for this are thought to be the advantage of sending and receiving remittances, and the possibility of financial investment and speculation.

“Particularly in countries facing currency depreciation and rising inflation (triggered or accentuated by the COVID-19 crisis), cryptocurrencies have been perceived as a way to protect household savings,” noted the UN Conference on Trade and Development. “Regardless of the motive for using cryptocurrencies, exchanges play a crucial role in enabling their wider deployment. Such exchanges function as clearing houses, intermediating conversions between cryptocurrencies and sovereign currencies.”

UN recommends more regulations and bans on bitcoin industry

However, far from being enthusiastic about the benefits of cryptocurrencies, the UN Conference on Trade and Development expressed concern. According to this body, the benefits “are overshadowed by the risks,” and for this reason “national regulatory responses” are needed to counter the challenge posed by bitcoin.

RELATED CONTENT: Venezuelan Cryptocurrency Petro Reaches Record High Value

For example, in Venezuela, there is the National Superintendence of Cryptoassets (SUNACRIP) which, according to its own mission statement, is the “first public institution with the exclusive functions of organizing, planning, regulating, promoting, and coordinating the adoption and use of the sovereign Petro cryptocurrency, cryptocurrencies and digital assets in Venezuela, to build the new digital economy for the protection of the Venezuelan people.”

Three risks of cryptocurrencies, according to UN

The UN Conference on Trade and Development mentioned three principal risks involving bitcoin and other cryptocurrencies:

Therefore, the UN body recommends banning banks from offering cryptocurrencies to their customers. As CriptoNoticias recently reported, commercial banks in Argentina and Mexico are subjected to similar regulations.

The UN Conference on Trade and Development also calls for regulating decentralized finance and banning or restricting the advertising of crypto exchanges and wallets in public spaces and social media.

Translation: Orinoco Tribune

OT/SC/SL